Cash Management Best Practices for Small Shops

Managing cash might seem like a simple part of running a small shop, but anyone who has worked behind a counter knows just how quickly small mistakes can turn into lost revenue, confusion, or even security risks. Whether you’re running a boutique, a food truck, a cafe, a repair shop, or a neighborhood convenience store, your daily cash flow is important not just for financial accuracy, but for protecting your business.

This guide will walk you through smart, proven cash management best practices, starting from counting and logging your takings, to safely storing them at the end of the day. We’ll also highlight security strategies such as dual-control counting and choosing fire-resistant, theft-deterrent safes to ensure your hard-earned money stays where it belongs.

Why Cash Management Matters More Than Ever

Even though digital payments are growing, cash isn't going anywhere. Many small shops still receive a large portion of their daily income in cash, especially those in high-foot-traffic and local community markets. But with cash comes responsibility:

- Cash is easily misplaced and difficult to trace.

- It can be stolen by outside threats, such as break-ins.

- It may be lost to internal theft if processes are unclear.

- Insurance claims may be denied if proper storage steps aren’t followed.

Strong cash management isn’t just about staying organized, it’s a form of business resilience. The safer and more documented your cash handling procedures are, the fewer surprises and losses you’ll encounter.

1. Counting the Cash: Start With Consistency

Your end-of-day cash count should not be a rushed task. Create a consistent procedure and follow it every day.

Use a Designated Counting Space

Set up a specific area that is:

- Out of public sight

- Free of distractions

- Clean and well-lit

This reduces mistakes and keeps your staff focused.

Count Cash Before and After Every Shift

Every employee who uses the register should:

- Begin their shift with a set starting amount (known as a “float”)

- End their shift by returning the register to that exact float amount

This makes discrepancies easy to track and reduces guesswork.

The Dual-Control System (Highly Recommended)

Never allow one person to count cash alone.

Instead, require two employees to:

- Count the cash together

- Verify totals

- Sign off

This is called dual control, and it’s one of the strongest internal theft deterrents available. Even if you trust your team, this system protects everyone, staff and owners alike.

2. Logging Your Daily Takings: Make It Traceable

Once the cash is counted, it needs to be recorded properly. Not all small businesses use accounting software, but every shop must keep a clear cash log.

Log Structure Should Include:

| Log Field | Description |

|---|---|

| Date | Day’s transaction date |

| Employee initials | Who counted and verified |

| Total sales | Total income |

| Cash in drawer | Total cash counted |

| Float amount | Amount left in register |

| Deposit amount | Cash taken to safe or bank |

Paper Logs vs. Digital Logs

Both are acceptable, what matters is clarity and accessibility.

Paper Logs

- Simple and reliable

- Keep in a binder stored securely

Digital Logs

- Use POS system exports

- Or a simple spreadsheet template

- Make sure files are backed up

Whatever you choose, never rely on memory or informal notes.

3. Securing the Cash: How You Store Money Matters

Once cash has been counted and logged, do not leave it in the register overnight. Registers are one of the first things targeted in a break-in. Even a locked register is easy to pry open with a screwdriver.

Move Cash to a Safe Immediately

The safe should be:

- Located out of public view

- Bolted down to the floor or wall

- In a staffed or monitored area

Small businesses often choose safes designed specifically for cash deposits throughout the day (drop safes) and long-term storage overnight (security safes or fire-resistant safes).

4. Reduce Your Risk Throughout the Day

Use a Drop Safe for Midday Deposits

If your register builds up too much cash, employees are at risk during:

- Busy checkout periods

- Shift changeovers

- Late-night closing

A drop safe allows staff to drop excess bills into the safe without opening it. This reduces temptation and exposure.

Avoid Counting Cash on the Sales Floor

This protects privacy and reduces visibility to customers or anyone passing by.

5. Protect Your Cash After Hours: Choose the Right Safe

The safe you choose matters. Not all safes are designed for burglary resistance, and not all are fire-resistant.

Here’s what to look for:

| Safe Feature | Why It Matters |

|---|---|

| Fire-Resistance Rating | Protects cash from accidental fire or arson |

| Solid Steel Construction | Prevents easy break-ins and drilling |

| Bolt-Down Capability | Keeps thieves from taking the safe itself |

| Drop Slot or Deposit Drawer | Allows secure deposits during business hours |

| Combination, Keypad, or Biometric Lock | Choose based on convenience + security level |

Recommended Templeton Safes Models for Small Shops

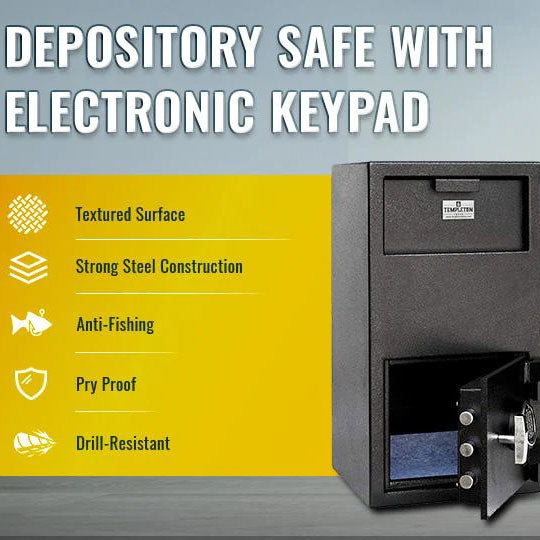

Templeton T861 Drop Safe

Ideal for shops that need to secure cash throughout the day without opening the safe. Staff can quickly drop bills into the slot, minimizing register exposure. Built with heavy steel walls and anti-fishing protections.

Templeton T701 / T702 Fire-Resistant Security Safes

Perfect for protecting backup cash reserves or important documents. These models have:

- Fire resistance

- High-strength steel construction

- Options for shelving and internal organization

An excellent option to reduce catastrophic loss if a break-in or fire occurs. Using a fire-resistant safe ensures that even in worst-case scenarios, your business can reopen and recover.

6. Limit Access to the Safe

A safe is only effective if access is controlled.

Best Practices:

- Only two trusted people should have the safe combination.

- Change combinations if a manager or employee leaves the business.

- Never write down safe codes where they can be found.

- Keep internal audits to verify correct safe procedures.

7. Make Bank Deposits Daily (When Possible)

The less cash you store on-site long-term, the safer you are.

Deposit Timing Tips

- If you close late at night, make deposits in the morning.

- Vary the time of your bank drop.

- Use secure deposit bags.

- Do not advertise routines.

Consistency helps your accounting, but predictability can create security risks, so vary the deposit schedule slightly from week to week.

Make Cash Handling Smart, Safe, and Secure

Good cash management systems don’t just protect your financial bottom line, they:

- Increase staff accountability

- Reduce internal and external theft opportunities

- Improve daily bookkeeping accuracy

- Strengthen business continuity in emergencies

By using dual-control counting, logging every transaction carefully, and storing daily takings securely in the right safe, you make your business tougher to target, and easier to operate confidently.

If your shop needs a reliable safe designed specifically for small business cash protection, explore Templeton Safes trusted options, designed to keep your income secure day and night.